| Filed by the Registrant | ☒ | Filed by a Party other than the Registrant | ☐ | |||

| |

| ☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)] |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under Sec. 240.14a-12 |

Swift

Holdings Inc.

| |

| ☒ | No fee required. |

| ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: N/A |

(2) | Aggregate number of securities to which transaction applies: N/A |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

(4) | Proposed maximum aggregate value of transaction: N/A |

(5) | Total fee paid: N/A |

| |

| ☐ | Fee paid previously with preliminary materials. |

| ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: N/A |

(2) | Form, Schedule or Registration Statement No.: N/A | |

| (3) | Filing Party: N/A | |

| (4) | Date Filed: N/A |

|

| |||

|

|

2200 S. 75th Avenue

Phoenix, Arizona 85043

Wednesday,

9:0030, 2019

Swift’s Corporate Offices

2200 S. 75th

85027

| |

| 1. | Elect |

|

|

| 2. | Conduct an advisory, |

|

|

| Ratify the appointment of |

| |

| 4. | Vote on a stockholder proposal |

|

|

| Transact any other business that may properly come before the meeting. |

By Order of the Board of Directors, |

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 30, 2019 The Company’s proxy statement for the stockholders for the fiscal year ended December 31, |

| ||||||

| ||||||

| LETTER FROM OUR LEAD INDEPENDENT DIRECTOR | ||||||

| |||||

|

| ||||

| Dear Fellow Stockholders: |

| The responsibilities of our Lead Independent Director include: | |||

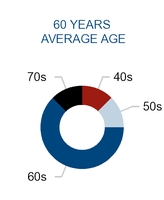

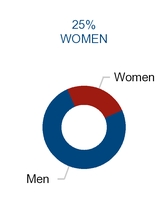

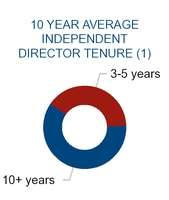

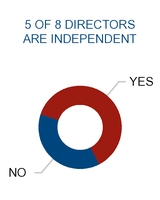

It has been my privilege to serve as Knight-Swift’s Lead Independent Director, working with a group of talented, knowledgeable, and committed directors. As I embark on another year of service as Lead Independent Director, I wanted to take this opportunity to highlight the many ways in which the Board has worked to provide independent oversight and address key areas of stockholder interest with a goal of delivering value for our stockholders and customers: Independent Board Oversight and Leadership The Board, which is comprised of approximately two-thirds independent members and has independent Audit, Compensation, Nominating and Corporate Governance, and Finance Committees, is actively engaged in oversight of management’s strategy, which has positioned Knight-Swift as a leader in the truckload transportation industry. In my role as Lead Independent Director, I preside over all executive sessions of the independent directors and maintain an active dialogue between the independent directors and management to facilitate efficient operation of the Board and effective oversight of the Company. In addition, as the representative of our independent directors, I participate in setting Board meeting agendas and developing materials to be distributed to the Board to ensure our discussions are focused on key risk areas and oversight of our strategic plans and goals to drive long-term growth and value creation for our stockholders. Strong Corporate Governance Standards We strive to maintain sound corporate governance practices, including a Board with an appropriate balance of expertise, diversity (25% of directors on our continuing Board are female and we have a female Lead Independent Director), tenure, and experience. To support an appropriate composition, we adopted a tenure policy in 2017, pursuant to which Messrs. Kraemer and Lehmann are retiring from our Board this year. In addition, Mr. Jerry Moyes, founder and former CEO of Swift, noted his appreciation of the Board’s composition and functionality, and stepped down from his position on the Board last year. Finally, Mr. Dozer has decided not to stand for reelection. We have been fortunate to have benefited from the expertise of Messrs. Dozer, Kraemer, Lehmann, and Moyes, and thank them for their many contributions. In furtherance of our commitment to outstanding corporate governance, we emphasize Board refreshment and conduct regular Board evaluations. Our Board does an annual Board self-assessment followed by a specific action plan to help guide the Board for the coming year. The Board is engaged in management succession planning. Developing talent and ensuring we have a deep bench for our key positions is critical. The risk oversight process by the Board and its Committees is rigorous. We also provide proxy access procedures, which allow our stockholders who have retained and held a sufficient ownership position in the Company to include stockholder-nominated director candidates in our proxy materials for annual meetings of stockholders. |

| ||||

| |||||

| Presiding at all executive sessions of the Board; | ||||

| Coordinating the activities of the independent directors; | ||||

| Providing information to the Board for consideration; | ||||

| Participating in setting Board meeting agendas, in consultation with the CEO and the Chairperson, and coordinating Board meeting schedules to assure that there is sufficient time for discussion of all agenda items; | ||||

| |||||

| Participating in the retention of outside advisors and consultants who report directly to the Board; | ||||

| Requesting the inclusion of certain materials for Board meetings; | ||||

| Consulting with respect to, and where practicable receiving in advance, information sent to the Board; | ||||

| Calling meetings of the independent directors; | ||||

| Acting as liaison for stockholders between the independent directors and the Chairperson, as appropriate; and | ||||

| ● | Responding directly to stockholder and other stakeholder questions that are directed to the Lead Independent Director or the independent directors as a group, as the case may be. | ||||

Industry-Leading Commitment to Reducing Climate Change Knight-Swift is an industry leader in environmental initiatives, committed to reducing our emissions through improved truck technology, cleaner fuels, and the training and awareness of our driving associates. We were one of the few trucking companies that collaborated with the U.S. Environmental Protection Agency on the development and deployment of the EPA Smartway program, and have employed several generations of EPA Smartway trailers that include aerodynamic fairings, low rolling resistance tires, and automatic tire inflation, which reduce greenhouse gases and criteria emissions. In addition, we have begun using new fuel efficient trucks in some of the country’s most polluted cities, led the clean truck movement in the ports of Los Angeles and Long Beach (which has resulted in cleaner air for residents and workers, encouraged the ultra-low sulfur diesel fuel mandate), and recycle our waste oil and used tires. We actively seek out and work to integrate new technology to further reduce our environmental impact. Focus on Capital Management and Maximizing Stockholder Returns One of the Board’s critical areas of focus is capital allocation strategies and creation of strong returns for our stockholders. We maintain a Finance Committee that is responsible for reviewing and monitoring the deployment of our financial resources and policies, the management of our balance sheet, and the investment of cash and other assets. The Finance Committee also periodically reviews our capital structure and discusses with the full Board and management our financial risk exposure relating to our financing activities. | |||||

| ||||||

| ||||||

We have returned value to our stockholders through the payment of quarterly dividends and share repurchases. The combined company has continued Knight’s historical practice of paying quarterly dividends to stockholders, and since the 2017 merger of Knight and Swift, we have returned approximately $60 million to our stockholders in dividends. In June 2018, the Board authorized a $250 million share repurchase plan, pursuant to which we have already repurchased nearly 6 million shares of our common stock for nearly $180 million. We endeavor to ensure that our executive compensation program, which our stockholders overwhelmingly approved under our annual advisory say-on-pay vote at our 2018 Annual Meeting, aligns with the long-term interests of our stockholders. Our Compensation Committee, with input from our independent compensation consultant, oversees a conservative executive compensation policy that positions target total compensation for our executive officers relative to the market median after taking into consideration experience, potential, and sustained individual performance. Moreover, target compensation is delivered through a mix of salary and annual long-term incentives that appropriately balance retention, short-and long-term goals, and pay-for-performance, while discouraging excessive risk taking. We also have adopted a clawback policy to discourage over-emphasizing short-term gains, and stock retention and anti-pledging and hedging policies intended to align our directors’ and officers’ interests with our stockholders’ long-term interests. The Board remains focused on its stewardship responsibilities and commitment to creating long-term value for our stockholders. On behalf of the Board, we welcome our stockholders’ feedback and look forward to providing further insights on the Board’s activities. We appreciate your support at the 2019 Annual Meeting. Sincerely, /s/ Kathryn Munro Kathryn Munro Lead Independent Director | ||||||

| ||||||||||||||

|

| |||||||||||||

| ||||||||||||||

|

| |||||||||||||

| Proxy Proposals | Board Vote Recommendation | Page | |||||||||||

| Thursday, May 30, 2019 8:30 a.m. Local Time | Elect three Class II directors, each such director to serve a term of three years, and two Class III directors, each such director to serve a term of one year | FOR | 13 | ||||||||||

|

| Conduct an advisory, non-binding vote to approve executive compensation | FOR | 32 | ||||||||||

| 20002 North 19th Ave Phoenix, AZ 85027 | |||||||||||||

| Ratify the appointment of Grant Thornton LLP (“GT”) as our independent registered public accounting firm for fiscal year 2019 | FOR | 32 | |||||||||||

| Stockholders of record on April 5, 2019 | |||||||||||||

| Vote on a stockholder proposal regarding Board declassification, if properly presented | NONE | 35 | |||||||||||

| ||||||||||||||

| ||||||||||||||

| 2018 Financial Achievements | ||||

| ● | Total revenue of $5.3 billion | |||

| ● | Revenue, excluding fuel surcharge of $4.7 billion | |||

| ● | Operating ratio improvement of 230 bps to 89.4% | |||

| ● | Adjusted operating ratio improvement of 140 bps to 86.9%(1) | |||

| ● | Cash flows from operations of $882.0 million | |||

| ● | Free cash flow of $351.8 million(2) | |||

| ● | Lease adjusted leverage ratio decreased by 37% compared to year end 2017(3) | |||

| ● | Repurchased $179.3 million of our common stock | |||

| ● | Returned $42.8 million in dividends to our stockholders | |||

| (1) Adjusted operating ratio is a non-GAAP financial measure defined as operating expenses, net of fuel surcharge revenue and certain non-recurring items, expressed as a percentage of revenue, excluding fuel surcharge revenue. See Part II, Item 7 of our Form 10-K for the year ended December 31, 2018 for a non-GAAP reconciliation. | ||||

| (2) Free cash flow is a non-GAAP financial measure defined as cash flow from operating activities, less net capital expenditures. See non-GAAP reconciliation on page 40. | ||||

| (3) See definition of lease adjusted leverage ratio on page 40. | ||||

| Corporate Governance Highlights | |||

| ü | Approximately two-thirds of our Board of Directors (“Board”) members are independent | ||

| ü | Robust lead independent director position with participation in setting agendas for Board meetings, coordinating Board meeting schedules to assure that there is sufficient time for discussion of all agenda items, provide information to the Board, coordinating activities of the independent directors, and authority to lead executive sessions of independent directors and act as liaison for stockholders between independent directors and the Chairperson | ||

| ü | Regular executive sessions of independent directors with lead independent director authority to call meetings of the independent directors | ||

| ü | Independent Audit, Compensation, and Nominating and Corporate Governance Committees | ||

| ü | All four members of the Audit Committee qualify as audit committee financial experts | ||

| ü | Majority voting standard and resignation policy for directors in uncontested elections | ||

| ü | Proxy access | ||

| ü | Annual risk oversight by full Board and Committees | ||

| ü | Stockholder right to call special meetings | ||

| ü | Robust director and key officer stock ownership guidelines, along with a key officer stock retention policy | ||

| ü | Stock Pledging and Hedging Policy (the “Anti-Pledging and Hedging Policy”) limiting the pledging and hedging of the Company’s securities by certain individuals with no hardship exemption | ||

| ü | Clawback policy | ||

| ü | Overboarding policy | ||

| ü | New director orientation program | ||

| ü | Annual Board self-assessment | ||

| ü | Annual Chief Executive Officer (“CEO”) evaluation | ||

| ü | Management and executive succession planning strategy | ||

| ü | Director communication policy | ||

| ü | Director tenure policy | ||

| Executive Compensation Highlights | |||

| ü | Conservative pay policy with named executive officer and director pay targeted to the market median | ||

| ü | Peer group designed to reflect companies we compete with for business and talent | ||

| ü | Direct link between pay and performance that aligns business strategies with stockholder value creation | ||

| ü | Appropriate balance between short- and long-term compensation that discourages short-term risk taking at the expense of long-term results | ||

| ü | Independent compensation consultant retained by the Compensation Committee to advise on executive compensation matters | ||

| ü | No re-pricing or back-dating of stock options | ||

| ü | No dividends paid on unvested stock awards | ||

| ü | No tax gross-up payments to cover personal income taxes relating to incentive compensation | ||

| ü | Clawback policy | ||

| ü | Annual CEO evaluation considered when setting CEO compensation | ||

| Environmental and Sustainability Highlights | |||

| ü | Industry leader in environmental initiatives | ||

| ü | One of few trucking companies participating in development and deployment of EPA Smartway program | ||

| ü | Frequent recipient of EPA Smartway Excellence Award | ||

| ü | Utilization of new fuel efficient trucks | ||

| ü | Leader in clean truck movement in ports of Los Angeles and Long Beach | ||

| ü | Trailers equipped with latest technology to reduce emissions, such as aerodynamic fairings, low rolling resistance tires, and automatic tire inflation | ||

| ü | Oil and tire recycling program | ||

| ü | Service on government air quality board of directors by Company executive | ||

| ü | Initial supporter of the ultra-low sulfur diesel fuel mandate, which was crucial for the technology of new diesel engines | ||

| ü | Ongoing review of the use of electric and hydrogen trucks through collaboration with manufacturers and inventors with the aim of reducing climate change | ||

| ü | Customers are encouraged to eliminate older polluting trucks | ||

| DEFINITIVE PROXY ON FORM 14A | |

| TABLE OF CONTENTS | |

| PAGE | |

Company merged with and into Knight Transportation, Inc. and we became Knight-Swift Transportation Holdings Inc. (the “2017 Merger”). Unless otherwise indicated or context otherwise requires, “Knight” refers to Knight Transportation, Inc. and its subsidiaries prior to the 2017 Merger and “Swift” refers to Swift Transportation Company and its subsidiaries prior to the 2017 Merger.

| Time and Date: |

|

Place: |

20002 North 19th Avenue, Phoenix, Arizona |

Record Date: |

|

Voting: | Stockholders as of the record date are entitled to vote. Each share of our |

the Company.

|

|

| ||

8 | ) | * | ||

Internet at www.proxyvote.com | calling 1-800-690-6903 | mail return the signed proxy card | ||

Annual Meeting.

1

|

|

| |||||||||

|

|

|

| ||||||||

|

|

|

| ||||||||

| Proxy Proposals | Board Vote Recommendation | Page | |||||||||

| Item 1. | Elect three Class II directors, each such director to serve a term of three years, and two Class III directors, each such director to serve a term of one year | FOR | 13 | ||||||||

| Item 2. | Conduct an advisory, non-binding vote to approve executive compensation | FOR | 32 | ||||||||

| Item 3. | Ratify the appointment of Grant Thornton LLP (“GT”) as our independent registered public accounting firm for fiscal year 2019 |

| 32 | ||||||||

| Item 4. | Vote on | NONE |

|

| |||||||

|

|

|

| ||||||||

|

|

|

| ||||||||

|

|

|

| ||||||||

2

|

|

|

|

|

| |||||||||||||||

|

|

| ||||||||||||||||||

| Name | Age | Professional Background | Independent | Committee Memberships | Other Current Company Boards | |||||||||||||||

| Class II | ||||||||||||||||||||

| Michael Garnreiter | 67 | Treasurer of |

|

|

| |||||||||||||||

|

|

|

|

|

| |||||||||||||||

|

|

|

|

|

| |||||||||||||||

|

|

|

| |||||||||||||||||

|

|

|

| Audit (Chair) | Axon Enterprises, Inc., Amtech Systems, Inc., Banner Health Systems | |||||||||||||||

David |

|

| Yes | Audit, Finance | Energy Bank, Inc., Bellin Psychiatric Hospital | |||||||||||||||

| Robert E. Synowicki, Jr. | 60 | Chief Financial Officer, Chief Operating Officer, and Chief Information Officer at various times with Werner Enterprises, Inc., a publicly traded national trucking company, for over 25 years, most recently serving as Executive Vice President of | Yes |

Finance, Nominating and |

| |||||||||||||||

| Class III | ||||||||||||||||||||

| David Jackson | 43 | Chief Executive Officer of Knight, and now Knight- Swift, and a member of the board of directors of Knight since January 2015, President of Knight, and now Knight-Swift, since February 2011, Chief Financial Officer from 2004 until 2012, Treasurer from 2006 to 2011 and Knight’s Secretary from 2007 to 2011 | No | None | None | |||||||||||||||

| Kevin Knight | 62 | Chairman of the board of directors of Knight since 1999 (including as the Executive Chairman since January 2015), CEO of Knight from 1993 through December 2014, currently serves as a full time executive officer of the Company in his role as Executive Chairman, from 1975 to 1984 in various roles at Swift, from 1986 to 1990 as Executive Vice President of Swift, and concurrently from 1988 to 1990 as President of Cooper Motor Lines, Inc., a former Swift subsidiary | No | Executive (Chair) | American Trucking Associations | |||||||||||||||

3

Corporate Governance Highlights

The Company is committed to good corporate governance practices that we believe recognizes stockholder interests and supports the success of our business. Our corporate governance practices, highlighted below, are described in greater detail in the “The Board of Directors and Corporate Governance” section.

|

|

|

|

|

|

|

|

|

|

HOLDINGS INC. ANNUAL MEETING OF STOCKHOLDERS THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE 85027. presiding at all executive sessions of the presiding at all meetings of our Board and the stockholders, coordinating the activities of the independent directors; requesting the inclusion of certain materials for Board meetings; consulting with respect to, and where practicable receiving in advance, information sent to the Board; collaborating with the CEO and communicating to the CEO, together with the responding directly to stockholder and other stakeholder questions and comments that are directed performing such other duties as our Board may delegate from time to time. Our Board will consist of 25% females following the Annual Meeting. DIRECTOR ATTENDANCE AT ANNUAL MEETING rules of the NYSE. Name Lead Independent Director Richard Kraemer* reviews the audit plans and findings of our independent registered public accounting firm and our internal audit and risk review staff, as well as the results of regulatory examinations, and tracks management’s corrective action plans where necessary; reviews our financial statements, including any significant financial items and/or changes in accounting policies, with our management and independent registered public accounting firm; reviews, with management and our independent registered public accounting firm, our financial risk and control procedures, compliance programs, and significant tax, legal, and regulatory matters; has the sole discretion to appoint annually, compensate, and oversee our independent registered public accounting firm, evaluate such firm’s independence and performance, regularly reviews matters and monitors compliance procedures with regularly meets with management, internal auditors, the independent auditors and the Board in executive session; reviews with management the Audit Committee Report for inclusion in the annually reviews the Audit Committee Charter for adequacy and compliance with the duties and responsibilities set forth therein. Mr. Synowicki served on the Audit Committee until June 2018, when he began to provide consulting services to us in the areas of driver recruitment and retention and resigned from the Audit Committee. Mr. Garnreiter has been designated as the audit committee financial expert. annually evaluates the performance of, determines, approves, and recommends to the Board the base salary, cash incentives, annually reviews corporate goals and objectives relevant to the compensation of our other executive officers and senior management and evaluates performance in light of those goals and objectives; approves base salary and other compensation of our other executive officers; approves and recommends to the Board annual cash and equity adopts, oversees, and periodically reviews and makes recommendations to the Board regarding the operation of all of annually reviews and makes recommendations to the Board regarding the outside directors’ compensation arrangements to ensure their competitiveness and compliance with applicable laws; annually reviews the Company’s cash and equity incentive performance goals and objectives including whether such goals were met; reviews with management the Compensation Discussion and Analysis (“CD&A”) for inclusion in the annually reviews the Compensation Committee Charter for compliance with the duties and responsibilities set forth therein. identifies, screens, and recommends qualified candidates to the Board for Board membership; advises the Board with respect to the Board composition, diversity, size, attributes, procedures, and committees; evaluates director nominee recommendations proposed by stockholders; oversees the evaluation of the recommends individuals to the Board for election by the stockholders or appointment by the Board; annually reviews the Nominating and Corporate Governance Committee Charter directors are responsible for attending Board meetings and meetings of committees on which they serve and to review in advance the Board’s principal responsibility is to oversee and direct the management of our at least our Nominating and Corporate Governance Committee is responsible for nominating qualified members for election to our Board; our Board believes that it is important for the independent directors will meet in executive session on a regular basis, but not less than any pledging or hedging transaction (including zero cost collars, forward sales contracts, puts, calls, and other derivative transactions) in the Company’s common stock. The Anti-Pledging and Hedging Policy does not have a hardship exemption. proxy statement. related party transactions were (in thousands): Provided by Swift Received by Swift Freight Services: Thermo King $ 1 $ — Central Freight Lines 83 26 SME Industries 830 — Other Affiliates — — Total $ 914 $ 26 Facility and Equipment Leases: Thermo King — — Central Freight Lines 1,154 372 Other Affiliates 19 — Total $ 1,173 $ 372 Other Services: Thermo King — $ 633 Central Freight Lines 24 — Swift Aircraft Management — 501 SME Industries 69 — Other Affiliates 11 17 Total $ 104 $ 1,151 Swift Receivable Swift Payable Central Freight Lines $ 118 $ 1 Thermo King — 22 SME Industries 72 — Other Affiliates 3 — Total $ 193 $ 23 three-year term. an annual retainer to each director of an annual an annual retainer of $15,000, paid in cash, to the an annual retainer of $10,000, paid in cash, to the an annual retainer of $7,500, paid in cash, to an annual retainer of $5,000, paid in cash, to each member of the Audit, Compensation, Nominating and Corporate Governance, reimbursement of expenses to attend Board and committee Name Fees Earned or Paid in Cash ($) Stock Awards Cash Value ($)(3) Total ($) Richard H. Dozer(2) 172,500 100,000 272,500 Glenn F. Brown(2) 97,750 100,000 197,750 José A. Cárdenas(2) 87,750 100,000 187,750 Jerry Moyes(1) — — — William F. Riley, III(2) 67,750 100,000 167,750 David N. Vander Ploeg(2) 105,250 100,000 205,250 As of December 31, Options(#) Shares of Restricted Class A Stock(#) Richard H. Dozer 4,000 17,405 Glenn F. Brown — 21,687 José A. Cárdenas — 11,275 William F. Riley, III — 11,227 David N. Vander Ploeg 4,000 21,687 Executive Executive Executive Weighting Threshold Target Stretch Maximum Level of Attainment-Percent of ECIP to be paid 30 % 100 % 200 % 300 % Adjusted EPS(1) 100 % $ 1.50 $ 1.62 $ 1.70 $ 1.80 Executive Base Salary Target Cash Incentive Percentage $ Amount of Cash Incentive at 100% Level of Attainment 2016 Cash Incentive Earned 2016 % of Salary at below threshold STIP Level of Attainment Richard Stocking $ 562,754 75 % $ 422,066 $ — — % Virginia Henkels $ 365,790 60 % $ 219,474 $ — — % Mickey R. Dragash $ 300,000 50 % $ 150,000 $ — — % Kenneth C. Runnels $ 273,182 50 % $ 136,591 $ — — % Steven Van Kirk $ 267,718 50 % $ 133,859 $ — — % Jerry Moyes $ 636,540 90 % $ 572,886 $ — — % Named Executive Officer Approximate Target LTIP(1) Stock Options(2) RSUs(3) PUs(4) Richard Stocking 175 % 44,888 21,589 20,954 Virginia Henkels 100 % 16,673 8,019 7,783 Mickey R. Dragash 75 % 10,526 4,932 4,787 Kenneth C. Runnels 75 % 9,116 4,384 4,255 Steven Van Kirk 75 % 6,062 2,916 2,830 Jerry Moyes 235 % 103,306 — 48,223 The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis included in this proxy statement. Based on its review and discussions with management, the Compensation Committee recommended to the Board, and the Board approved, that the Compensation Discussion and Analysis be included in this proxy statement and in the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2018. Kraemer Name and Principal Position Year Salary ($) Stock Awards ($)(3) Option Awards ($)(4) Non-Equity Incentive Plan Compensation (5) All Other Compensation ($)(6) Total ($) Richard Stocking 2016 562,754 659,842 324,840 — 7,911 1,555,347 President and Chief 2015 560,232 672,518 331,391 211,033 6,104 1,781,278 Executive Officer 2014 537,883 621,947 305,431 335,194 5,477 1,805,932 Virginia Henkels 2016 365,790 245,089 120,657 — 7,911 739,447 Executive Vice-President and 2015 364,151 249,791 123,084 109,737 6,104 852,867 Chief Financial Officer 2014 349,624 230,996 113,450 176,716 5,477 876,263 Mickey R. Dragash(2) 2016 300,000 150,741 74,219 — 14,306 539,266 Executive Vice-President, General Counsel and Secretary Kenneth C. Runnels 2016 273,182 133,991 65,970 — 8,151 481,294 Executive Vice-President 2015 271,958 139,899 68,943 68,295 6,344 555,439 Fleet Operations 2014 262,847 129,385 63,543 104,843 5,477 566,095 Steven Van Kirk 2016 267,718 89,120 43,869 — 8,752 409,459 Executive Vice-President 2015 266,518 131,627 64,863 62,000 6,344 531,352 Swift, President Intermodal 2014 267,296 126,822 63,543 105,320 5,859 568,840 Jerry Moyes(1) 2016 626,747 747,939 747,591 — 5,404 2,127,681 Former Chief Executive 2015 535,759 762,315 762,656 — 9,691 2,070,421 Officer 2014 614,538 726,145 724,014 454,972 2,744 2,522,413 2018 Name Grant Date Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) Estimated Future Payouts under Equity Incentive Plan Awards(2) All Other Stock Awards: Number of shares of stock or units (#)(3) All Other Option Awards: Number of Securities Underlying options (#)(4) Exercise or Base Price of Option Awards ($/Sh) Grant Date Fair Value of Stock and option Awards ($)(5) Thres hold ($) Target (s) Max ($) Thres hold (#) Target (#) Max (#) Richard Stocking 211,033 422,066 1,266,198 — — — — — — — 5/24/16 — — — 10,477 20,954 41,908 — — — 324,997 5/24/16 — — — — — — 21,589 — — 334,845 5/24/16 — — — — — — — 44,888 15.51 324,840 Virginia Henkels 109,737 219,474 658,422 — — — — — — 5/24/16 — — — 3,892 7,783 15,566 — — — 120,714 5/24/16 — — — — — — 8,019 — — 124,375 5/24/16 — — — — — — — 16,673 15.51 120,657 Mickey R. Dragash 75,000 150,000 450,000 — — — — — — 5/24/16 — — — 2,394 4,787 9,574 — — — 74,246 5/24/16 — — — — — — 4,932 — — 76,495 5/24/16 — — — — — — — 10,526 15.51 74,219 Kenneth C. Runnels 68,295 136,591 409,773 — — — — — — — 5/24/16 — — — 2,128 4,255 8,510 — — — 65,995 5/24/16 — — — — — — 4,384 — — 67,996 5/24/16 — — — — — — — 9,116 15.51 65,970 Steven Van Kirk 66,930 401,577 267,718 — — — — — — — 5/24/16 — — — 1,415 2,830 5,660 — — — 43,893 5/24/16 — — — — — — 2,916 — — 45,227 5/24/16 — — — — — — — 6,062 15.51 43,869 Jerry Moyes 286,443 572,886 1,718,658 — — — — — — — 5/24/16 — — — 24,112 48,223 96,446 — — — 747,939 5/24/16 — — — — — — — 103,306 15.51 747,591 Option Awards Stock Awards Name Number of Securities Underlying Unexercised Options (#) Exercisable Number of Securities Underlying Options (#) Unexercisable (1) Option Exercise Price ($) Option Expiration Date Number of Shares or Units of Stock That Have Not Vested (#)(2) Market Value of Shares or Units of Stock That Have Not Vested ($)(4) Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#)(3) Equity Incentive Plan Awards: Market Value of Unearned Shares, Units or Rights That Have Not Vested ($)(4) Richard Stocking 80,000 — 11.00 10/16/2017 40,839 994,846 41,862 1,019,750 40,000 — 8.61 12/31/2019 — — — — 32,000 — 8.80 2/25/2020 — — — — 54,722 — 13.36 2/22/2023 — — — — 22,566 11,283 23.30 5/6/2024 — — — — 14,702 29,405 24.84 5/20/2025 — — — — — 44,888 15.51 5/24/2026 — — — — Virginia Henkels 78,000 — 11.00 8/27/2018 15,168 369,502 15,549 378,764 24,000 — 8.80 2/25/2020 — — — — 20,325 — 13.36 2/22/2023 — — — — 8,382 4,191 23.30 5/6/2024 — — — — 5,460 10,922 24.84 5/20/2025 — — — — — 16,673 15.51 5/24/2026 — — — — Mickey R. Dragash — 10,256 15.51 5/24/2026 10,970 267,229 4,787 116,611 Kenneth C. Runnels 4,694 2,348 23.30 5/6/2024 8,390 204,372 8,604 209,602 3,058 6,118 24.84 5/20/2025 — — — — — 9,116 15.51 5/24/2026 — — — — Steven Van Kirk 4,600 2,301 23.30 5/6/2024 6,767 164,838 6,984 170,136 2,877 5,756 24.84 5/20/2025 — — — — — 6,062 15.51 5/24/2026 — — — — Jerry Moyes (5) 132,270 — 13.36 3/31/2017 13,214 321,892 96,863 2,359,584 103,306 — 15.51 3/31/2017 53,492 26,746 23.30 12/31/2019 — — — — 33,835 67,672 24.84 12/31/2019 — — — — Name Option Shares Vesting Grant Date Vesting Date Exercise Price Richard Stocking 11,283 5/6/2014 5/6/2017 23.30 14,702 5/20/2015 5/20/2017 24.84 14,703 5/20/2015 5/20/2018 24.84 14,962 5/24/2016 5/24/2017 15.51 14,963 5/24/2016 5/24/2018 15.51 14,963 5/24/2016 5/24/2019 15.51 Virginia Henkels 4,191 5/6/2014 5/6/2017 23.30 5,461 5/20/2015 5/20/2017 24.84 5,461 5/20/2015 5/20/2018 24.84 5,557 5/24/2016 5/24/2017 15.51 5,558 5/24/2016 5/24/2018 15.51 5,558 5/24/2016 5/24/2019 15.51 Mickey R. Dragash 3,418 5/24/2016 5/24/2017 15.51 3,419 5/24/2016 5/24/2018 15.51 3,419 5/24/2016 5/24/2019 15.51 Kenneth C. Runnels 2,348 5/6/2014 5/6/2017 23.30 3,059 5/20/2015 5/20/2017 24.84 3,059 5/20/2015 5/20/2018 24.84 3,038 5/24/2016 5/24/2017 15.51 3,039 5/24/2016 5/24/2018 15.51 3,039 5/24/2016 5/24/2019 15.51 Steven Van Kirk 2,301 5/6/2014 5/6/2017 23.30 2,878 5/20/2015 5/20/2017 24.84 2,878 5/20/2015 5/20/2018 24.84 2,020 5/24/2016 5/24/2017 15.51 2,021 5/24/2016 5/24/2018 15.51 2,021 5/24/2016 5/24/2019 15.51 Jerry Moyes 26,746 5/6/2014 5/6/2017 23.30 33,836 5/20/2015 5/20/2017 24.84 33,836 5/20/2015 5/20/2018 24.84 2018 Option Awards Stock Awards Name Number of Shares Acquired on Exercise (#) Value Realized on Exercise ($) Number of Shares Acquired on Vesting (#) Value Acquired on Vesting ($) Richard Stocking - - 38,202 661,202 Virginia Henkels - - 14,190 245,601 Mickey R. Dragash - - 3,019 71,701 Kenneth C. Runnels 155,726 2,108,155 8,129 140,784 Steven Van Kirk 11,492 130,926 7,931 137,425 Jerry Moyes - - 52,769 944,037 Name Executive Contributions in Last FY ($)(1) Registrant Contributions in Last FY ($)(2) Aggregate Earnings in Last FY(3) Aggregate Withdrawals/ Distributions in Last FY ($) Aggregate Balance at Last FYE(1) Jerry Moyes — — — — — Richard Stocking — — — — — Virginia Henkels 265,198 — 41,287 — 470,834 Mickey R. Dragash 38,654 — 3,840 — 53,987 Kenneth C. Runnels — — — — — Steven Van Kirk 33,291 — 7,123 — 83,455 Option Awards RSU Awards PU Awards Name Unvested Options (#) Intrinsic Value of Unvested Options ($) (#) ($) (#) ($) Total Value Upon Change in Control ($) Richard Stocking 85,576 409,219 35,265 859,055 47,436 1,155,541 2,423,815 Virginia Henkels 31,786 151,999 13,098 319,067 17,619 429,199 900,265 Mickey R. Dragash 10,256 90,766 10,970 267,229 4,787 116,611 474,606 Kenneth C. Runnels 17,582 83,165 7,230 176,123 9,764 237,851 497,139 Steven Van Kirk 14,119 56,088 5,630 137,147 8,121 197,828 391,062 Name Cash Payments ($) Total Value of Options, RSU Awards and PU Awards ($) (1) Total Value Received on Termination by the Company without “cause” or by the NEO for “good reason” ($) Richard Stocking 2,144,132 414,217 2,558,349 Virginia Henkels 877,896 153,851 1,031,747 Mickey R. Dragash 675,000 38,870 713,870 Cash Payments ($) Total Value of Accelerated Options ($)(1) Total Value of PUs($)(2) Total Value Received ($) 4,800,000 914,258 962,658 6,676,916 Shares Beneficially Owned Name and Address of Beneficial Owner(1)(2) Class of Common Stock # of Shares Percent of Class A Common Stock(3) Percent of Total Common Stock(4) Percent of Total Voting Power(5) Named Executive Officers and Directors: Jerry Moyes(6)(7) B 47,541,938 — 35.6 % 51.9 % Jerry Moyes(8) A 10,834,403 12.9 % 8.1 % 5.9 % Richard Stocking(9) A 332,427 * * * Virginia Henkels(10) A 180,283 * * * Mickey R. Dragash(11) A 7,022 * * * Steven Van Kirk(12) A 24,265 * * * Kenneth C. Runnels(13) A 30,382 * * * Richard H. Dozer(14) A 21,405 * * * David N. Vander Ploeg(15) A 25,687 * * * Glenn F. Brown(16) A 46,687 * * * William F. Riley, III(17) A 19,227 * * * José A. Cárdenas (18) A 11,275 * * * All executive officers and directors as a group (13 persons) A&B 59,083,368 N/A 44.1 % 58.1 % Other 5% Stockholders Moyes Affiliated Holdings M Capital Group Investors, LLC(19) B 10,595,659 — 8.0 % 11.6 % M Capital Group Investors II, LLC(20) B 26,213,049 — 19.7 % 28.6 % Cactus Holding Company, LLC(21) B 8,354,978 — 6.3 % 9.1 % Cactus Holding Company II, LLC(22) B 2,378,252 — 1.8 % 2.6 % Cactus Holding Company, LLC(21) A 1,951,006 2.3 % 1.5 % 1.1 % Cactus Holding Company II, LLC(22) A 8,650,471 10.4 % 6.5 % 4.7 % Other Unaffiliated Third Party Holdings Wellington Management Group LLP(23) 280 Congress St. Boston, MA 02210 A 8,726,667 10.4 % 6.5 % 4.8 % Black Rock, Inc.(24) 40 East 52nd Street New York, NY 10022 A 4,791,093 5.7 % 3.6 % 2.6 % The Vanguard Group(25) 100 Vanguard Blvd. Malvern, PA 19355 A 7,032,058 8.4 % 5.3 % 3.8 % FMR LLC 245 Summer Street Boston, MA 02210(26) A 9,487,038 11.4 % 7.1 % 5.2 % Act. RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2019 the Company. The Audit Committee assists the Board in its oversight of the acceptability and quality of the accounting principles; the reasonableness of significant accounting judgments and critical accounting policies and estimates; the clarity of disclosures in the financial statements; and the adequacy and effectiveness of and for the fiscal year ended 2018. Code of Conduct and the Complaint Review Policy. 2017 Merger. 4: Meeting to present his proposal. The proposal and supporting statement below (collectively, the “Stockholder Proposal”) are presented in this proxy statement as received from the proponent in accordance with the rules of the SEC; we and our Board disclaim any responsibility for their content. Any references in the Stockholder Proposal statement to “we,” “our,” or similar words are references to the proponent of the proposal and not to the Company, our other stockholders, or our Board. this proposal. THE BOARD OF DIRECTORS’ STATEMENT IN RESPONSE TO THE STOCKHOLDER PROPOSAL statement. IS NEITHER OPPOSING NOR SUPPORTING THE STOCKHOLDER PROPOSAL AND MAKES NO VOTING RECOMMENDATION TO with the exception of one inadvertent late report regarding a purchase of shares by Mr. Richard Lehmann and one inadvertent late report regarding a gift of shares by Mr. Gary Knight.PROXY STSTATEMENTATEMENTSWIFTKNIGHT-SWIFT TRANSPORTATION COMPANY2200 South 75th AvenuePhoenix, Arizona 85043To be held on May 24, 2017The Board of Directors (the “Board”) of Swift Transportation Company (the “Company”, “Swift”, “we, or “our”) is furnishing you this proxy statement in connection with the solicitation of proxies on its behalf for the 2017 Annual Meeting of Stockholders (“Annual Meeting”). The meeting will take place at Swift’s corporate offices which are located at 2200 S. 75th Avenue, Phoenix, Arizona 85043, on Wednesday, May 24, 2017, at 9:00 a.m. local time. At the meeting, stockholders will vote on: (i) the election of the six directors named in this proxy statement; (ii) an advisory approval of the compensation of Swift’s named executive officers; (iii) an advisory vote on the frequency of future votes to approve the compensation of Swift’s named executive officers; (iv) the ratification of KPMG as Swift’s independent registered public accounting firm for the fiscal year 2017; (v) a stockholder proposal to develop a recapitalization plan and (vi) a stockholder proposal to adopt proxy access. Annual Meeting Details Proxy Proposals Board Vote Recommendation Page When Thursday, May 30, 20198:30 a.m. Local TimeElect three Class II directors, each such director to serve a term of three years, and two Class III directors, each such director to serve a term of one year FOR 13 Conduct an advisory, non-binding vote to approve executive compensation FOR 32 Where 20002 North 19th AvePhoenix, AZ 85027Ratify the appointment of Grant Thornton LLP (“GT”) as our independent registered public accounting firm for fiscal year 2019 FOR 32 Who Votes Stockholders ofrecord on April 5, 2019Vote on a stockholder proposal regarding Board declassification, if properly presented NONE 35 Stockholders also will consider any other matters that may properly come before the meeting, although we know of no other business to be presented.By submitting your proxy (either by signing and returning the enclosed proxy card, by voting electronically on the Internet or by telephone), you authorize Virginia Henkels, Swift’s Executive Vice-PresidentDavid Jackson, our President and CEO, and Adam Miller, our Chief Financial Officer (“CFO”) and Mickey R. Dragash, Swift’s Executive Vice-President, General Counsel and Secretary,Treasurer, to represent you and vote your shares at the Annual Meeting in accordance with your instructions. Also, they may vote your shares to adjourn the Annual Meeting and will be authorized to vote your shares at any postponements or adjournments of the Annual Meeting.Swift’sA Notice of Internet Availability of Proxy Materials (the “Internet Notice”) will first be mailed on or about April 19, 2019, to stockholders of record of our common stock at the close of business on April 5, 2019, which is the record date. The Internet Notice will instruct you as to how you may access and review the proxy materials. This proxy statement, the proxy card, and our Annual Report to Stockholders for the fiscal year ended December 31, 2016,2018 (our “2018 Annual Report”), which includescollectively comprise our “proxy materials,” are first being made available to stockholders on April 19, 2019.The information included in this proxy statement should be reviewed in conjunction with the Company’s fiscal 2016 audited consolidated financial statements, accompaniesnotes to consolidated financial statements, reports of our independent registered accounting firm, and other information included in our 2018 Annual Report that will first be made available on or about April 19, 2019, together with this notice of Annual Meeting and proxy statement. Althoughstatement, to all stockholders of record of our common stock as of the record date, April 5, 2019. A copy of our 2018 Annual Report will be made available free of charge on the Annual Reports section of our corporate website at www.knight-swift.com. Except to the extent it is incorporated by specific reference, our 2018 Annual Report is being distributed withnot incorporated into this proxy statement it doesand is not constituteconsidered to be a part of the proxy solicitation materials and is not incorporated by reference into this proxy statement.We are first sending the proxy statement, form of proxy and accompanying materials to stockholders on or about April 14, 2017.QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETINGWHEN AND WHERE IS THE ANNUAL MEETING?Date:Wednesday, May 24, 2017Time:9:00 a.m., Local TimeLocation:Swift’s Corporate Offices2200 S. 75th AvenuePhoenix, Arizona 85043WHAT MATTERS WILL BE VOTED UPON AT THE ANNUAL MEETING?At the Annual Meeting, you will be asked to:Vote upon a proposal to elect nominees: Richard H. Dozer, Glenn F. Brown, José A. Cárdenas, Jerry Moyes, William F.��Riley, III and David N. Vander Ploeg as directors to hold office for a term of one year, expiring at the close of the Annual Meeting of Stockholders in 2018 or until their successors are duly elected and qualified or until their earlier resignation or removal;Vote (on an advisory basis) to approve the compensation of Swift’s named executive officers;Vote (on an advisory basis) on the frequency of future votes on the compensation of Swift’s named executive officers;Vote upon a proposal to ratify the appointment of KPMG as Swift’s independent, registered public accounting firm for the 2017 calendar year;Vote on a stockholder proposal to develop a recapitalization plan;Vote on a stockholder proposal to adopt proxy access; andTransact such other business as may properly come before the Annual Meeting or any adjournments thereof.WHAT CONSTITUTES A QUORUM?The presence, either in person or by proxy, of the holders of shares of common stock representing at least a majority of the voting power of our common stock outstanding and entitled to vote is required to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes, which are described in more detail below, are counted as shares present at the Annual Meeting for purposes of determining whether a quorum exists.WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING?If a quorum is not present at the meeting, the holders of a majority of voting power of the shares (but in any event not less than one-third of such shares) of the shares entitled to vote at the meeting who are present, in person or represented by proxy, or the chairman of the meeting, may adjourn the meeting until a quorum is present. The time and place of the adjourned Annual Meeting will be announced at the time the adjournment is taken and no other notice will be given.Only stockholders of record of Swift’s common stock at the close of business on March 31, 2017, which is the “record date,” are entitled to notice of, and to vote at, the Annual Meeting. Shares that may be voted include shares that are held:directly by the stockholder of record; andbeneficially through a broker, bank or other nomineeEach share of our Class A common stock will be entitled to one vote on all matters submitted for a vote at the Annual Meeting. Each share of our Class B common stock will be entitled to two votes on all matters submitted for a vote at the Annual Meeting.As of the record date, March 31, 2017 there were 83,518,819 shares of our Class A common stock issued and outstanding and entitled to be voted at the Annual Meeting and 49,741,938 shares of our Class B common stock issued and outstanding and entitled to be voted at the Annual Meeting.WHAT IS THE DIFFERENCE BETWEEN HOLDING SHARES AS A “REGISTERED OWNER” AND A “BENEFICIAL OWNER”?Most of Swift’s Class A stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between registered shares and those owned beneficially:Registered Owners — If your shares are registered directly in your name with our transfer agent, Wells Fargo Shareowner Services, you are, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting.Beneficial Owners — If your shares are held in a brokerage account, bank or by another nominee, you are, with respect to those shares, the “beneficial owner” of shares held in street name. As the beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote or to vote in person at the Annual Meeting. However, since you are not a stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, bank or other nominee (who is the stockholder of record) giving you the right to vote the shares.WHAT IS A BROKER NON-VOTE?Generally, a “broker non-vote” occurs when a broker, bank or other nominee that holds shares in “street name” for a customer is precluded from exercising voting discretion on a particular proposal because the: (i) beneficial owner has not instructed the nominee on how to vote; and (ii) nominee lacks discretionary voting power to vote on such issues.Under the rules of the New York Stock Exchange (“NYSE”), as discussed below, a nominee does not have discretionary voting power with respect to the approval of “non-routine” matters absent specific voting instructions from the beneficial owners of such shares.WHAT IS THE EFFECT OF NOT CASTING YOUR VOTE?Under the rules of the NYSE, a record holder does not have discretionary voting power with respect to the approval of “non-routine” matters absent specific voting instructions from the beneficial owners of such shares. Other than the proposal to ratify the appointment of KPMG, all of the proposals are considered non-routine matters. Therefore, your shares will not be voted without your specific instructions. Thus, if you hold your shares in street name and you do not instruct your record holder how to vote in the election of directors (Proposal 1), the advisory vote to approve the compensation of Swift’s named executive officers (Proposal 2), the advisory vote no the frequency of future votes to approve the compensation ofSwift’s named executive officers (Proposal 3), the vote on the stockholder proposal to develop a recapitalization plan (Proposal 4), or the stockholder proposal to adopt proxy access (Proposal 6), no votes will be cast on your behalf. Your record holder will, however, continue to have the ability to vote your shares in its discretion on the ratification of the appointment of the independent registered public accounting firm (Proposal 3).WHAT STOCKHOLDER APPROVAL IS NECESSARY FOR APPROVAL OF THE PROPOSALS?Election of Directors (Proposal 1)Each director shall be elected by a majority of the votes cast with respect to that director. This means that a director must receive more “for” than “against” votes with respect to that director. However, if the number of nominees is greater than the number of directors to be elected, the directors will be elected by the vote of a plurality of the shares represented in person or by proxy at any stockholder meeting. Broker non-votes and abstentions will have no effect on the outcome of this proposal.Advisory Vote to Approve the Compensation of Swift’s Named Executive Officers (Proposal 2)Approval of this resolution requires the affirmative vote of a majority of the votes cast by the stockholders entitled to vote thereon who are present in person or represented by proxy at the Annual Meeting. Broker non-votes and abstentions will have no effect on the outcome of this proposal. While this vote is required by law, it is not binding on the Company or the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation decisions.Advisory Vote on the Frequency of Future Advisory Votes on the Compensation of Swift’s Named Executive Officers (Proposal 3)Generally, approval of any matter presented to stockholders requires a majority of votes cast. However, because this vote is advisory and nonbinding, if none of the frequency options receives a majority of the votes cast, the option receiving the greatest number of votes will be considered the frequency recommended by the Company’s stockholders. Broker non-votes and abstentions will have no effect on the outcome of this proposal. Even though this vote is not binding on the Company or the Board, the Board will take into account the outcome of this vote in making a determination on the frequency with which future advisory votes on executive compensation will be included in Swift’s proxy statement.Ratification of the Appointment of KPMG as Swift’s Independent Registered Public Accounting Firm (Proposal 4)The ratification of the Audit Committee’s appointment of KPMG as Swift’s independent registered public accounting firm for the fiscal year 2017 requires the affirmative vote of a majority of the votes cast by the stockholders entitled to vote thereon who are present in person or represented by proxy at the Annual Meeting. Broker non-votes and abstentions will have no effect on the outcome of this proposal. Stockholder ratification is not required for the appointment of Swift’s independent registered public accounting firm. However, we are submitting the proposal to solicit the opinion of our stockholders.Vote on Shareholder Proposal to Develop a Recapitalization Plan (Proposal 5)Approval of this proposal requires the affirmative vote of a majority of the votes cast by the stockholders entitled to vote thereon who are present in person or represented by proxy at the Annual Meeting. Broker non-votes and abstentions will have no effect on the outcome of this proposal.Vote on Shareholder Proposal to Adopt Proxy Access (Proposal 6)Approval of this proposal requires the affirmative vote of a majority of the votes cast by the stockholders entitled to vote thereon who are present in person or represented by proxy at the Annual Meeting. Broker non-votes and abstentions will have no effect on the outcome of this proposal.MAY I VOTE MY SHARES IN PERSON AT THE ANNUAL MEETING?If you are the registered owner of shares of Swift’s common stock on the record date, you have the right to vote your shares in person at the Annual Meeting.If you are the beneficial owner of shares of Swift’s common stock on the record date, you may vote these shares in person at the Annual Meeting if you have requested a legal proxy from your broker, bank or other nominee (the stockholder of record) giving you the right to vote the shares at the Annual Meeting. You will need to complete such legal proxy and present it to Swift at the Annual Meeting.Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy card or voting instructions so that your vote will be counted if you later decide not to attend the Annual Meeting.HOW CAN I VOTE MY SHARES WITHOUT ATTENDING THE ANNUAL MEETING?If you are a registered owner, you may instruct the named proxy holders on how to vote your shares by completing, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided with this proxy statement, or by using the internet voting site or the toll-free telephone number listed on the proxy card. Specific instructions for using the internet and telephone voting systems are on the proxy card. The internet and telephone voting systems will be available until 11:59 p.m. Mountain Standard Time on Monday, May 23, 2017 (the day before the Annual Meeting).If you are the beneficial owner of shares held in street name, you should instruct your broker, bank or other nominee on how to vote your shares. Your broker, bank or other nominee has enclosed with this proxy statement a voting instruction card for you to use in directing your nominee on how to vote your shares. The instructions from your nominee will indicate whether internet or telephone voting is available and, if so, will provide details regarding how to use those systems.HOW WILL MY PROXY BE VOTED?Shares represented by a properly executed proxy (in paper form, by Internet or by telephone) that are received in a timely manner, and not subsequently revoked, will be voted at the Annual Meeting or any adjournment or postponement thereof in the manner directed on the proxy. Virginia Henkels and Mickey R. Dragash are named as proxies on the proxy form and have been designated by the Board as the directors’ proxies to represent you and vote your shares at the Annual Meeting. All shares represented by a properly executed proxy on which no choice is specified will be voted:(1)FOR the election of the six nominees for director named in this proxy statement;(2)FOR the resolution approving, on an advisory basis, the compensation of Swift’s named executive officers;(3)FOR a one year frequency for future votes to approve the compensation of Swift named executive officers(4)FOR the ratification of the appointment of KPMG as Swift’s independent registered public accounting firm for the 2017 calendar year;(5)AGAINST the stockholder proposal to develop a recapitalization plan;(6)AGAINST the stockholder proposal to adopt proxy access; and(7)in accordance with the proxy holders’ best judgment as to any other business that properly comes before the Annual Meeting.MAY I REVOKE MY PROXY AND CHANGE MY VOTE?Yes. You may revoke your proxy and change your vote at any time prior to the vote at the Annual Meeting.If you are the registered owner, you may revoke your proxy and change your vote by:submitting a new proxy bearing a later date (which automatically revokes the earlier proxy);giving notice of your changed vote to us in writing mailed to the attention of Mickey R. Dragash, Corporate Secretary, at our executive offices;attending the Annual Meeting and giving oral notice of your intention to vote in person; orre-voting by telephone or internet.You should be aware that simply attending the Annual Meeting will not in and of itself constitute a revocation of your proxy.WILL MY VOTE BE KEPT CONFIDENTIAL?Yes, your vote will be kept confidential and not disclosed to the Company unless:required by law;you expressly request disclosure on your proxy; orthere is a proxy contest.WHO WILL PAY THE COSTS OF SOLICITING PROXIES?Swift will bear all costs of this proxy solicitation. In addition to soliciting proxies by this mailing, our directors, officers and regular employees may solicit proxies personally or by mail, telephone, facsimile or other electronic means for which solicitation they will not receive any additional monetary compensation. Swift will reimburse brokerage firms, custodians, fiduciaries and other nominees for their out-of-pocket expenses in forwarding solicitation materials to beneficial owners upon our request.WHAT OTHER BUSINESS WILL BE PRESENTED AT THE ANNUAL MEETING?As of the date of this proxy statement, the Board knows of no other business that may properly be, or is likely to be, brought before the Annual Meeting. If any other matters should arise at the Annual Meeting, the persons named as proxy holders, Virginia Henkels and Mickey R. Dragash will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting. If, for any unforeseen reason, any of the director nominees are not available to serve as a director the named proxy holders will vote your proxy for such other director candidate or candidates as may be nominated by the Board.WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING?Swift intends to report voting results of the Annual Meeting on Form 8-K within four business days after the Annual Meeting.WHAT SHOULD I DO IF I RECEIVE MORE THAN ONE SET OF VOTING MATERIALS?You may receive more than one set of voting materials. These materials may include multiple copies of this proxy statement and multiple proxies or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for eachbrokerage account. If you are a registered owner and your shares are registered in more than one name you will receive more than one proxy card. Please vote each proxy and instruction card that you receive.WHO CAN HELP ANSWER MY QUESTIONS?If you have questions concerning a proposal, or the Annual Meeting, are requesting additional copies of this proxy statement, or if you need directions to or special assistance at the Annual Meeting, please call the Corporate Secretary at 1-800-800-2200, extension 907-3574 or email the Corporate Secretary at mick_dragash@swifttrans.com. In addition, information regarding the Annual Meeting is available via the Internet at our website, www.swifttrans.com.CORPORATE GOVERNANCE DOCUMENTSIn furtherance of its goals of providing effective governance of Swift’sour business and affairs for the long-term benefit of stockholders, and promoting a culture and reputation of the highest ethics, integrity and reliability the Board has adopted Corporate Governance Guidelines. Specifically,Guidelines in addition to charters for each of its Board committees and a Code of Business Conduct and Ethics (the “Code of Conduct”) for our directors, officers, and employees of the Company.employees. Each of these documents is free and available for download in the corporate governance section of the Investor Relations page at www.swifttrans.com.www.knight-swift.com. You may also obtain a copy by writing to SwiftKnight-Swift Transportation Company,Holdings Inc., c/o Corporate Secretary, 2200 S. 75th Ave.,20002 North 19th Avenue, Phoenix, Arizona 85043.RISK MANAGEMENT AND OVERSIGHTOur full Board oversees our risk management process, as well asWe take a company-wide approach to risk management, carried out byand our management.full Board has overall responsibility for and oversees our risk management process on an annual basis. Our full Board: (i) determines the appropriate risk for us as an organization; (ii) assesses the specific risks faced; and (iii) reviews the appropriate steps to be taken by management in order to manage those risks. While the full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, our Compensation Committee is responsible for overseeing the management of risks relating to our executive and non-executive compensation planspolicies and practices and the incentives created by theour compensation awards it administers.policies and practices. Our Audit Committee oversees assessment and management of enterprise risks as well as financialrisks and is responsible for overseeing potential conflicts of interests. Our Nominating and Corporate Governance Committee is responsible for overseeing implementation of appropriate corporate governance procedures, monitoring and overseeing the management and mitigation of operating risks, and overseeing the management of risks associated with the independence of our Board. Our Nominating and Corporate Governance Committee also reviews enterprise operating risks, other than financial and internal controls risks. Our Finance Committee monitors and mitigates risks relating to our deployment of financial resources, the management of our balance sheet, and the investment of cash and other assets. Our Merger Integration Committee monitored risks associated with integration efforts in connection with the 2017 Merger. Following the successful integration of Swift and Knight, the Merger Integration Committee was dissolved in May 2018. Pursuant to the Board’s instruction, management regularly reports on applicable risks to the relevant committee or the full Board. As appropriate, additional review or reporting on risks are conducted as needed or as requested by our Board and its committees.Our Board currently consists of six members:eleven members, divided into three classes: Kathryn Munro (Class I), Gary Knight (Class I), Kevin Knight (Class II), Michael Garnreiter (Class II), David Jackson (Class II), Robert Synowicki, Jr. (Class II), Richard H. Dozer Glenn F. Brown, José A. Cárdenas,(Class II) (not standing for reelection), David Vander Ploeg (Class II), Richard Lehmann (Class III) (retiring at Annual Meeting), Richard Kraemer (Class III) (retiring at Annual Meeting), and Roberta Roberts Shank (Class III).Subsequent to the 2018 Annual Meeting, Mr. Jerry Moyes, William F. Riley,a former Class III director, resigned as a director of the Company. In accordance with our tenure policy, Messrs. Richard Lehmann and Richard Kraemer, are retiring at the Annual Meeting, and Mr. Richard Dozer, a Class II director, has decided not to stand for reelection at the Annual Meeting.Given these developments, to rebalance the number of directors in each class, our Board has nominated Messrs. Michael Garnreiter, David N. Vander Ploeg. Ploeg, and Robert Synowicki, Jr. as Class II directors to hold office for a term of three years, expiring at the close of the 2022 Annual Meeting of Stockholders and has nominated Messrs. David Jackson and Kevin Knight as Class III directors to hold office for a term of one year, expiring at the close of the 2020 Annual Meeting of Stockholders, or until, in each case, their successors are elected and qualified or until their earlier resignation or removal.All of these directors, other than Mr. MoyesMessrs. Gary Knight, Kevin Knight, and Mr. Riley,Jackson, qualify as independent directors under the corporate governance standards of the NYSE and the independence requirements of Rule 10A-3 of the Securities Exchange Act of 1934 (the “Exchange Act”). Our Board requires; provided, after June 2018 Mr. Synowicki did not meet the separationAudit Committee independence requirements due to his consulting assistance to the Company regarding driver recruiting and retention.The table below provides information on the qualifications, skills, characteristics, and experience of our proposed nominees and continuing directors. Mr. Garnreiter Mr. Jackson Mr. Gary Knight Mr. Kevin Knight Ms. Munro Mr. Vander Ploeg Ms. Roberts Shank Mr. Synowicki, Jr. Experience Public Company Officer ü ü ü ü ü ü Financial Reporting ü ü ü ü ü ü ü ü Industry ü ü ü ü ü Environmental ü ü ü ü ü ü ü ü Risk Management ü ü ü ü ü ü ü ü Demographic/Background Independent Yes No No No Yes Yes Yes Yes(1)Gender Male Male Male Male Female Male Female Male Tenure (years) 17 5 29 29 15 11 4 4 Age (years) 67 43 67 62 70 60 52 60 (1) Mr. Synowicki is independent for all purposes except service on the Audit Committee after June 2018. The lack of a “ü” for a particular item does not mean that the director does not possess that qualification, characteristic, skill or experience. We look to each director to be knowledgeable in these areas; however, the “ü” indicates that the item is a specific qualification, characteristic, skill or experience that the director brings to the Board.BOARD LEADERSHIP STRUCTUREWe separate the offices of the ChairmanChairperson of our Board and our Chief Executive Officer (“CEO”).CEO. Currently, our independentExecutive Chairman of the Board is Richard H. Dozer.Kevin Knight. Separating the offices of Chairperson and CEO allows our CEO to dedicate his full efforts to the demands and responsibilities of the CEO position, while also allowing us to benefit from Kevin Knight’s strategic oversight and considerable experience. Our Board will be free to choose the ChairmanChairperson in any way that it deems best for us at any given point in time, provided that the Chairman may not be our CEO or any other employee of Swift. Mr. Dozer is not an employeetime. The duties of the Company nor does Mr. Dozer have any other affiliationsChairperson include:serving on the Executive Committee;presiding at all meetings of our Board and the stockholders at which the Chairperson is present;participating in setting Board meeting agendas, in consultation with the Company; thereby qualifying Mr. Dozer as anCEO and lead independent director, and coordinating Board meeting schedules to assure that there is sufficient time for servicediscussion of all agenda items;collaborating with the CEO and lead independent director in determining the need for special meetings and calling any such special meeting;responding directly to stockholder and other stakeholder questions and comments that are directed to the Chairperson of the Board; andperforming such other duties as our Chairman of the Board. Board may delegate from time to time.If the ChairmanChairperson of the Board is not an independent director, our Board’s independent directors will designate one of the independent directors on the Board to serve as lead independent director. In addition, ifCurrently, our CEOlead independent director is apermitted holder or an affiliated person (as defined in our certificate of incorporation), the Chairman of our Board must be an independent director.Kathryn Munro. The duties of the Chairman, or the lead independent director if the Chairman is not independent, include:Board;independent directors;(inwhere the caseChairperson is not present;performing all duties of the absence or disability of the Chairperson;lead independent director, whereChairperson in the Chairman is not present);providing information to the Board for consideration;schedules to assure that there is sufficient time for discussion of all agenda items;preparingparticipating in setting Board meeting agendas, in consultation with the CEO and lead independent director or Chairman, as the case may be,Chairperson, and coordinating Board meeting schedules;authorizingparticipating in the retention of outside advisors and consultants who report directly to the Board;meetings and calling any such special meeting;lead independent director or Chairman, as the case may be,Chairperson in determining the need for special meetings;in the casecalling meetings of the lead independent director, directors;acting as liaison for stockholders between the independent directors and the Chairman,Chairperson, as appropriate;chairmanChairperson of the Compensation Committee, the results of the Board’s evaluation of the CEO’s performance; to the Chairman of the Board, or to the lead independent director or the independent directors as a group, as the case may be; andIn the absence or disability of the Chairman,Chairperson, the duties of the ChairmanChairperson (including presiding at all meetings of our Board and the stockholders) shall be performed and the authority of the ChairmanChairperson may be exercised by anthe lead independent director or another independent director designated for this purpose by our Board. The ChairmanChairperson of our Board (if he or she is an independent director) or the lead independent director if any, may only be removed from such position with the affirmative vote of a majority of the independent directors and only for the reasons set forth in our bylaws. Includingby-laws, including a determination by a majority of the independent directors that the ChairmanChairperson or lead independent director, as the case may be, is not exercisingfulfilling his or her dutiesresponsibilities in a manner that is in the best interests of Swiftthe Company and ourits stockholders.BOARD DIVERSITYThe Company prefers a mix of background and experience among its members. The Board does not follow any ratio or formula to determine the appropriate mix. Rather, it uses its judgment to identify nominees whose backgrounds, attributes, and experiences, taken as a whole, will contribute to the high standards of Board service to the Company. The effectiveness of this approach is evidenced by the directors’ participation in insightful and robust, yet mutually respectful, deliberation that occurs at Board and committee meetings.BOARD MEETINGSThe Board held ten5 meetings during the 20162018 calendar year. During 2016,2018, all directors attended at least 75% of the aggregate of the Board and committee meetings on which they sit. sit, except that Mr. Lehmann was unable to attend the meeting held by the Executive Committee during 2018.All sixSix of the Company’s then incumbentour then-incumbent directors attended Swift’s 2016our 2018 Annual Meeting of Stockholders. Directors are invited and encouraged to attend the Company’s annual meetingmeetings of stockholders.BOARD COMMITTEESAs a result of Jerry Moyes and affiliates controlling a majority of the vote of our voting common stock, Swift qualifies as a “controlled company” within the meaning of the corporate governance listing standards of the NYSE. As such, we have the option to elect not to comply with certain of such listing standards. However, consistent with our goal to implement strong corporate governance standardsstockholders, although we do not currently, nor do we intend to, elect to be treated ashave a “controlled company” under the rulesformal policy regarding director attendance at our annual meetings of the NYSE.Ourstockholders.BOARD COMMITTEESCurrently, our Board has an Audit Committee (AC), Compensation Committee and(CC), Nominating and Corporate Governance Committee.Committee (NGC), Finance Committee (FC), and Executive Committee (EC). Following the successful integration of Swift and Knight, the Merger Integration Committee was dissolved in May 2018. Each committee, except our Executive Committee, is composed entirely of independent directors, each of whom is a “non-employee director” as defined in Rule 16b-3(b)(3) under the Exchange Act and, for 2017, an “outside“independent director” within the meaning of Section 162(m)(4)(c)(i)for purposes of the Internal Revenue Code.Members serve on these committees until their respective resignations or until otherwise determined by our Board. Our Board may from time to time establish other committees.Current committee memberships are as follows:IndependentACCCNGCEC Richard H. Dozer

ü Kevin Knight Executive Chairman of the Board Yes

Glenn F. BrownYes

José A. CárdenasYes

Jerry MoyesNoWilliam F. Riley, IIINoü ü

Richard Lehmann* ü

ü Roberta Roberts Shank ü ü Robert Synowicki, Jr. ü ü David N. Vander PloegYes

ü =Member

ü =Member

= Committee Chairperson

= Committee ChairpersonCommitteeChairmanAC = AuditCommitteeCC = CompensationCommitteeNGC = Nominating and Corporate Governance Committee* Messrs. Kraemer and Lehmann are retiring at the Annual Meeting and Mr. Dozer is not standing for reelectionAudit CommitteeThe Audit Committee held 10 meetings in 2016.2018. The Audit Committee performs the following functions: and set clear policies for our hiring of employees or former employees of the independent registered public accounting firm, and pre-approve all audit services and permitted non-audit services to be performed by our independent registered public accounting firm;Swift’sour internal audit department as well as oversees performance of the internal audit department;oversees investigation and resolution of complaints submitted under Swift’s Whistleblower policy;